We provide which are the best for clearing CAPM test, and to get certified by PMI Certified Associate in Project Management (PMI-100). The covers all the knowledge points of the real CAPM exam. Crack your PMI CAPM Exam with latest dumps, guaranteed!

PMI CAPM Free Dumps Questions Online, Read and Test Now.

NEW QUESTION 1

An output of the Perform Integrated Change Control process is:

- A. Deliverables.

- B. Validated changes.

- C. The change log.

- D. The requirements traceability matri

Answer: C

NEW QUESTION 2

The process improvement plan details the steps for analyzing processes to identify activities which enhance their:

- A. quality.

- B. value.

- C. technical performance.

- D. statu

Answer: B

NEW QUESTION 3

Analogous cost estimating relies on which of the following techniques?

- A. Expert judgment

- B. Project management software

- C. Vendor bid analysis

- D. Reserve analysis

Answer: A

NEW QUESTION 4

Quality metrics are an output of which process?

- A. Plan Quality

- B. Perform Quality Control

- C. Perform Quality Assurance

- D. Perform Qualitative Risk Analysis

Answer: A

NEW QUESTION 5

Which document in the project management plan can be updated in the Plan Procurement Management process?

- A. Budget estimates

- B. Risk matrix

- C. Requirements documentation

- D. Procurement documents

Answer: C

NEW QUESTION 6

In a construction project schedule, what is the logical relationship between the delivery of the concrete materials and the pouring of concrete?

- A. Start-to-start (SS)

- B. Start-to-finish (SF)

- C. Rnish-to-finish (FF)

- D. Finish-to-start (FS)

Answer: D

NEW QUESTION 7

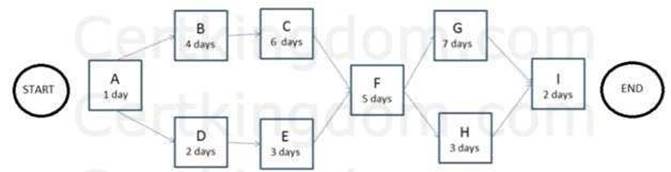

The following is a network diagram for a project.

The free float for Activity E is how many days?

- A. 2

- B. 3

- C. 5

- D. 8

Answer: C

NEW QUESTION 8

Who determines which dependencies are mandatory during the Sequence Activities process?

- A. Project manager

- B. External stakeholders

- C. Internal stakeholders

- D. Project team

Answer: D

NEW QUESTION 9

A method of obtaining early feedback on requirements by providing a working model of the expected product before actually building is known as:

- A. Benchmarking.

- B. Context diagrams.

- C. Brainstorming.

- D. Prototypin

Answer: D

NEW QUESTION 10

Projects can be divided into phases to provide better management control. Collectively, what are these phases known as?

- A. Complete project phase

- B. Project life

- C. The project life cycle

- D. Project cycle

Answer: C

NEW QUESTION 11

Which of the following is an output of Define Scope?

- A. Project scope statement

- B. Project charter

- C. Project plan

- D. Project schedule

Answer: A

NEW QUESTION 12

Which output of Project Cost Management consists of quantitative assessments of the probable costs required to complete project work?

- A. Activity cost estimates

- B. Earned value management

- C. Cost management plan

- D. Cost baseline

Answer: A

NEW QUESTION 13

Funding limit reconciliation is a tool and technique used in which process?

- A. Control Costs

- B. Determine Budget

- C. Estimate Costs

- D. Control Budget

Answer: B

NEW QUESTION 14

In the basic communication model, which term refers to the method that is used to convey the message?

- A. Decode

- B. Encode

- C. Medium

- D. Noise

Answer: C

NEW QUESTION 15

Which process documents the business needs of a project and the new product, service, or other result that is intended to satisfy those requirements?

- A. Develop Project Management Plan

- B. Develop Project Charter

- C. Direct and Manage Project Execution

- D. Collect Requirements

Answer: B

NEW QUESTION 16

Which of the following change requests can bring expected future performance of the project work in line with the project management plan?

- A. Corrective action

- B. Defect repair

- C. Preventative action

- D. Probable action

Answer: A

NEW QUESTION 17

Which action should a project manager take to ensure that the project management plan is effective and current?

- A. Conduct periodic project performance reviews.

- B. Identify quality project standards.

- C. Follow ISO 9000 quality standards.

- D. Complete the quality control checklis

Answer: A

NEW QUESTION 18

Define Activities and Estimate Activity Resources are processes in which project management Knowledge Area?

- A. Project Time Management

- B. Project Cost Management

- C. Project Scope Management

- D. Project Human Resource Management

Answer: A

Thanks for reading the newest CAPM exam dumps! We recommend you to try the PREMIUM Passcertsure CAPM dumps in VCE and PDF here: https://www.passcertsure.com/CAPM-test/ (704 Q&As Dumps)