Proper study guides for Up to date Oracle Oracle Accounting Hub Cloud 2020 Implementation Essentials certified begins with Oracle 1z0-1060-20 preparation products which designed to deliver the Realistic 1z0-1060-20 questions by making you pass the 1z0-1060-20 test at your first time. Try the free 1z0-1060-20 demo right now.

Check 1z0-1060-20 free dumps before getting the full version:

NEW QUESTION 1

How many transaction event classes can be set up for a subledger uploaded to Accounting Hub Cloud?

- A. Two

- B. One

- C. Three

- D. Unlimited

Answer: B

NEW QUESTION 2

Which is used to track a specific transaction attribute on subledger journal entries?

- A. value set rules

- B. lookup value rules

- C. supporting references

- D. account rules

Answer: C

NEW QUESTION 3

Most of the accounting entries for transaction from the source system use TRANSACTION_AMOUNT as a source of the entered amount accounting attribute. For some events, you need to use the TAX_AMOUNT source.

At what level can you override the default accounting attribute assignment?

- A. Journal Entry

- B. Journal Entry Rule Set

- C. Event Class

- D. Journal Line Rule

- E. Event Type

Answer: D

NEW QUESTION 4

To support foreign currency transaction in Accounting Hub, which accounting attributes must be assigned a source?

- A. Conversion type and conversion date

- B. Conversion type, conversion date and conversion rate

- C. Conversion date and conversion rate

- D. Conversion type

Answer: C

NEW QUESTION 5

Which two can you use to view supporting reference balances?

- A. Use the Supporting Reference Balance Inquiry page.

- B. Submit the standard Supporting Reference Balances Report.

- C. Use Oracle Transactional Business Intelligence to create an analysis using the Subledger Accounting - Supporting Reference Real Time subject area.

- D. Use Business Intelligence Publisher to build a custom report.

Answer: AC

NEW QUESTION 6

'Insurances for Homes' company provide home insurance service. They have in-house built system that

processes home insurance payments received from customers. The end result of the process consists of a listing of individual journal entries in a spreadsheet. They have requirements for getting all journal entries in a secure and auditable repository. Access will be limited to selective staff members. Additionally, be able to report and view the entries using an advanced reporting and analytical tools for slicing and dicing the Journal entries.

Which is a correct example for a formula to prorate amounts evenly across each period? Note that the NumberofGLPeriod is a predefined function that returns the number of non adjustment accounting periods between two dates.

- A. "Amount" *( NumberofGLPeriod ("Effective Date", "Last Day of Current Accounting Period") + 1)/ (NumberofGLPeriod ("Effective Date", "Expiiy Date") + 1)

- B. "Amount" - ("Last Day of Current Accounting Period" - "Effective Date" ) / ("Expiry Date" -"Effective Date")

- C. "Amount" * ("Last Day ol Current Accounting Period" - "Effective Date" + 1) / (("Expiry Date" "Effective Date") + 1)

- D. "Amount" * NumberofGLPeriod ("Effective Date", "Last Day of Current Accounting Period") / NumberofGLPeriod ("Effective Date", 'Expiry Date")

Answer: D

NEW QUESTION 7

You are explaining to an accountant that account override is an adjustment feature of Subledger Accounting. Which two traits can help you explain this feature?

- A. The account override feature provides an audit trail by preserving the original subledger journal entry.

- B. The account override feature adjusts the original source transaction.

- C. The account override feature is only intended to correct subledger journals that have been posted.

- D. The account override feature allows users to record a reason for the adjustment.

Answer: AD

NEW QUESTION 8

While creating a journal entry rule set you are NOT able to use an account rule that was created recently.

Which two reasons can explain this?

- A. The account rule is using sources that have not been assigned to the same event class that is associated to the journal entry rule set.

- B. The account rule is defined with conditions that are not allowing the assignment.

- C. The account rule does not return any valid account value.

- D. The account rule is defined with a different chart of accounts from the journal entry rule set.

Answer: AD

NEW QUESTION 9

Given the business use case:

'New Trucks' runs a fleet of trucks in a rental business In the U.S. The majority of the trucks are owned; however, in some cases, 'New Truck' may procure other trucks by renting them from third parties to their customers. When trucks are leased, the internal source code is 'L'. When trucks are owned, the internal source code is 'O'. This identifies different accounts used for the Journal entry. Customers sign a contract to initiate the truck rental for a specified duration period. The insurance fee is included in the contract and recognized over the rental period. For maintenance of the trucks, the "New Trucks* company has a subsidiary company 'Fix Trucks' that maintains its own profit and loss entity. To track all revenue, discounts, and maintenance expenses, 'New Trucks' needs to be able to view: total maintenance fee, total outstanding receivables, rental payment discounts, and total accrued and recognized insurance fee income.

How can the automatic recognition of insurance income be implemented in Accounting Hub Cloud?

- A. Set up multiperiod accounting journal lines.

- B. Set up a transaction line reversal.

- C. Create an adjustment journal entry.

- D. Set up automatic Journal line reversal.

Answer: A

NEW QUESTION 10

What automation option is NOT available when uploading transaction data to Accounting Hub Cloud?

- A. ERP Integration Service

- B. Oracle Web Center Content Client Command line tool

- C. Oracle Virtual Web Center Services

- D. Oracle UCM Web Services

Answer: C

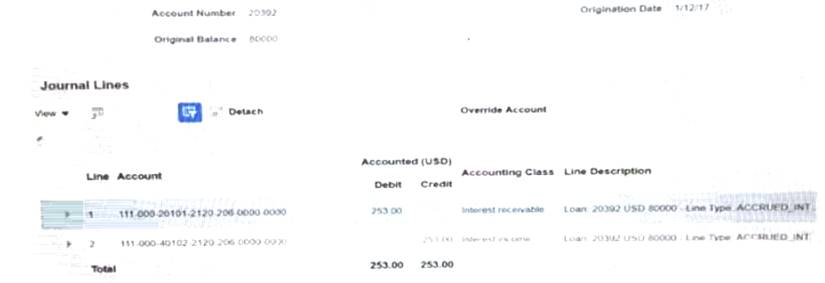

NEW QUESTION 11

Given the journal:

What is the terminology that is used to identify the "Account Number', 'Original Balance' , and 'Origination Date' fields?

- A. User Transaction Identifier

- B. Attribute Identifier

- C. Source System Identifier

- D. System Identifier

Answer: B

NEW QUESTION 12

A customer has a business requirement to provide additional information about subledger Journals that cannot be found in a predefined report.

How can you meet this requirement?

- A. Use either Account Monitor or Account Inspector to get required Information.

- B. Build a Financial Reporting Studio report that includes all dimensions.

- C. Build an OTBI analysis that includes a relevant subject area.

- D. Create a Smart View report using the query designer feature.

Answer: C

NEW QUESTION 13

You need to build a complex account rule. Which four value typescanyou use in yourdefinition?

- A. Value Set

- B. Constant

- C. Existing Account Rule

- D. Account Combination

- E. Mapping Set

- F. Source

Answer: BCEF

NEW QUESTION 14

A new source system has been registered into Accounting Hub Cloud. Users are actively using this new subledqer. Subsequently, the business signed up a contract with a new supplier. A new mapping value that maps suppliers with the accounts needs to be added. You make updates on the mappings in the existing mapping set rule by adding more mapping valued.

After saving the update, what is the next required action?

- A. Activate the journal entry rule set.

- B. Activate the accounting method.

- C. There is no required actio

- D. The mapping addition is complete.

- E. Download a new transaction data template.

Answer: C

NEW QUESTION 15

Given the business use case:

'New Trucks' runs a fleet of trucks in a rental business In the U.S. The majority of the trucks are owned; however, in some cases, 'New Truck' may procure other trucks by renting them from third parties to their customers. When trucks are leased, the internal source code is 'L'. When trucks are owned, the internal source code is 'O'. This identifies different accounts used for the Journal entry. Customers sign a contract to initiate the truck rental for a specified duration period. The insurance fee is included in the contract and recognized over the rental period. For maintenance of the trucks, the "New Trucks* company has a subsidiary company 'Fix Trucks' that maintains its own profit and loss entity. To track all revenue, discounts, and maintenance expenses, 'New Trucks' needs to be able to view: total maintenance fee, total outstanding receivables, rental payment discounts, and total accrued and recognized insurance fee income.

What wil the typical transaction information be at the header level?

- A. Line Type

- B. Currency

- C. Amount

- D. Customer Number

Answer: D

NEW QUESTION 16

......

P.S. Easily pass 1z0-1060-20 Exam with 60 Q&As 2passeasy Dumps & pdf Version, Welcome to Download the Newest 2passeasy 1z0-1060-20 Dumps: https://www.2passeasy.com/dumps/1z0-1060-20/ (60 New Questions)