we provide Guaranteed AHIP AHM-520 exam guide which are the best for clearing AHM-520 test, and to get certified by AHIP Health Plan Finance and Risk Management. The AHM-520 Questions & Answers covers all the knowledge points of the real AHM-520 exam. Crack your AHIP AHM-520 Exam with latest dumps, guaranteed!

Free demo questions for AHIP AHM-520 Exam Dumps Below:

NEW QUESTION 1

An actuary for the Noble Health Plan observed that the plan's actual morbidity was lower than its assumed morbidity and that the plan's actual administrative expenses were higher than its assumed administrative expenses. In this situation, Noble's actual underwriting margin was

- A. larger than its assumed underwriting margin, and the plan's actual expense margin was higher than its assumed expense margin

- B. larger than its assumed underwriting margin, but the plan's actual expense margin was lower than its assumed expense margin

- C. smaller than its assumed underwriting margin, but the plan's actual expense margin was higher than its assumed expense margin

- D. smaller than its assumed underwriting margin, and the plan's actual expense margin was lower than its assumed expense margin

Answer: B

NEW QUESTION 2

The provider contract that Dr. Zachery Cogan, an internist, has with the Neptune Health Plan calls for Neptune to reimburse him under a typical PCP capitation arrangement. Dr. Cogan serves as the PCP for Evelyn Pfeiffer, a Neptune plan member. After hospitalizing Ms. Pfeiffer and ordering several expensive diagnostic tests to determine her condition, Dr. Cogan referred her to a specialist for further treatment. In this situation, the compensation that Dr. Cogan receives under the PCP capitation arrangement most likely includes Neptune's payment for

- A. All of the diagnostic tests that he ordered on M

- B. Pfeiffer

- C. His visits to M

- D. Pfeiffer while she was hospitalized

- E. The cost of the services that the specialist performed for M

- F. Pfeiffer

- G. All of the above

Answer: B

NEW QUESTION 3

In order to analyze costs for internal management purposes, the Banner health plan uses functional cost analysis. One characteristic of this method of cost analysis is that it

- A. Enables Banner's top management to analyze costs as they apply to workflow rather than to organizational structures

- B. Assumes that activities, not products, generate costs

- C. Cannot be used when Banner makes pricing and staffing decisions

- D. Identifies units of activity, calculates the costs of performing each unit of activity, and then assigns the cost of each unit of activity to Banner's products or lines of business

Answer: A

NEW QUESTION 4

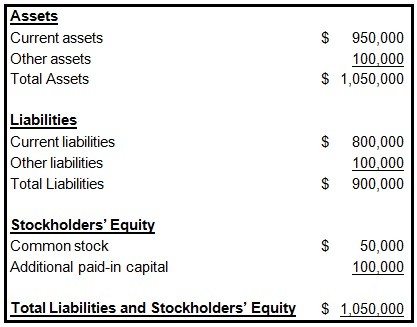

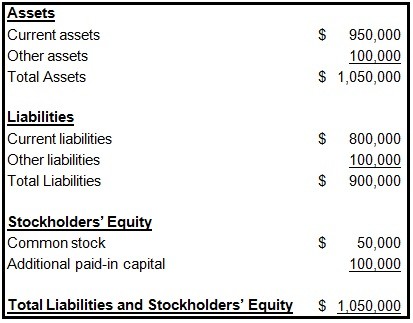

The following information was presented on one of the financial statements prepared by the Rouge health plan as of December 31, 1998:

When calculating its cash-to-claims payable ratio, Rouge would correctly divide its:

- A. Cash by its reported claims only

- B. Cash by its reported claims and its incurred but not reported claims (IBNR)

- C. Reported claims by its cash

- D. Reported claims and its incurred but not reported claims (IBNR) by its cash

Answer: B

NEW QUESTION 5

The following statements are about a health plan's underwriting of small groups. Select the answer choice containing the correct statement.

- A. Almost all states prohibit health plan s from rejecting a small group because of the nature of the business in which the small business is engaged.

- B. Most states prohibit health plans from setting participation levels as a requirement for coverage, even when coverage is otherwise guaranteed issue.

- C. In underwriting small groups, a health plan's underwriters typically consider both the characteristics of the group members and of the employer.

- D. Generally, a health plan's underwriters require small employers to contribute at least 80% of the cost of the healthcare coverage.

Answer: C

NEW QUESTION 6

The Essential Health Plan markets a product for which it assumed total expenses to equal 92% of premiums. Actual data relating to this product indicate that expenses equal 89% of premiums. This information indicates that the expense margin for this product has:

- A. a 3% favorable deviation

- B. a 3% adverse deviation

- C. an 11% favorable deviation

- D. an 11% adverse deviation

Answer: A

NEW QUESTION 7

For each of its products, the Wisteria Health Plan monitors the provider reimbursement trend and the residual trend. One true statement about these trends is that

- A. The provider reimbursement trend probably is more difficult for Wisteria to quantify than is the residual trend

- B. Wisteria's residual trend is the difference between the total trend and the portion of the total trend caused by changes in Wisteria's provider reimbursement levels

- C. The residual trend most likely has more impact on Wisteria's total trend than does the provider reimbursement trend

- D. An example of a residual trend would be a 5% increase in the capitation rate paid to a PCP by Wisteria

Answer: B

NEW QUESTION 8

If the Ascot health plan's accountants follow the going-concern concept under GAAP, then these accountants most likely

- A. Assume that Ascot will pay its liabilities immediately or in full during the current accounting period

- B. Defer certain costs that Ascot has incurred, unless these costs contribute to the healthplan's future earnings

- C. Assume that Ascot is not about to be liquidated, unless there is evidence to the contrary

- D. Value Ascot's assets more conservatively than they would under SAP

Answer: C

NEW QUESTION 9

The Fiesta Health Plan prices its products in such a way that the rates for its products are reasonable, adequate, equitable, and competitive. Fiesta is using blended rating to calculate a premium rate for the Murdock Company, a large employer. Fiesta has assigned a credibility factor of 0.6 to Murdock. Fiesta has also determined that Murdock's manual rate is $200 PMPM and that Murdock's experience rate is $180 PMPM.

According to regulations, Fiesta's premium rates are reasonable if they

- A. vary only on the factors that affect Fiesta's costs

- B. are at a level that balances Fiesta's need to generate a profit against its need to obtain or retain a specified share of the market in which it conducts business

- C. are high enough to ensure that Fiesta has enough money on hand to pay operating expenses as they come due

- D. do not exceed what Fiesta needs to cover its costs and provide the plan with a fair profit

Answer: D

NEW QUESTION 10

The reimbursement arrangement that Dr. Caroline Monroe has with the Exmoor Health Plan includes a typical withhold arrangement. One true statement about this withhold arrangement is that, for a given financial period,

- A. D

- B. Monroe and Exmoor are equally responsible for making up the difference if cost overruns exceed the amount of money withheld

- C. Exmoor most likely distributes to D

- D. Monroe the entire amount withheld from her if her costs are below the amount budgeted for the period

- E. Exmoor pays D

- F. Monroe at the end of the period an amount over and above her usual reimbursement, and this amount is based on the performance of the plan as a whole

- G. Exmoor most likely withholds between 3% and 5% of D

- H. Monroe's total reimbursement

Answer: B

NEW QUESTION 11

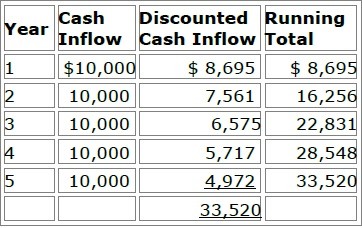

In order to print all of its forms in-house, the Prism health plan isconsidering the purchase

of 10 new printers at a total cost of $30,000. Prismestimates that the proposed printers have a useful life of 5 years. Under itscurrent system, Prism spends $10,000 a year to have forms printed by a localprinting company. Assume that Prism selects a 15% discount rate based onits weighted-average costs of capital. The cash inflows for each year,discounted to their present value, are shown in the following chart:

Prism will use both the payback method and the discounted payback methodto analyze the worthiness of this potential capital investment. Prism's decisionrule is to accept all proposed capital projects that have payback periods offour years or less.

Now assume that Prism decides to use the net present value (NPV) method toevaluate this potential investment's worthiness and that Prism will accept theproject if the project's NPV is greater than $4,000. Using the NPV method,Prism would correctly conclude that this project should be

- A. Rejected because its NPV is $3,520

- B. Accepted because its NPV is $5,028

- C. Accepted because its NPV is $16,480

- D. Accepted because its NPV is $23,520

Answer: A

NEW QUESTION 12

Several federal agencies establish rules and requirements that affect health plans. One of these agencies is the Department of Labor (DOL), which is primarily responsible for ______.

- A. Issuing regulations pertaining to the Health Insurance Portability and Accountability Act (HIPAA) of 1996

- B. Administering the Medicare and Medicaid programs

- C. Administering ERISA, which imposes various documentation, appeals, reporting, and disclosure requirements on employer group health plans

- D. Administering the Federal Employees Health BenefitsProgram (FEHBP), which providesvoluntary health insurance coverage to federal employees, retirees, and dependents

Answer: C

NEW QUESTION 13

The Column health plan is in the process of developing a strategic plan.

The following statements are about this strategic plan. Three of the statements are true, and one statement is false. Select the answer choice containing the FALSE statement.

- A. Human resources most likely will be a critical component of Column's strategic plan because, in health plan markets, the size and the quality of a health plan's provider network is often more important to customers than are the details of a product's benefit design.

- B. Column's strategic plan should only address how the health plan will differentiate its products, rather than where and how it will sell these products.

- C. Column most likely will need to develop contingency plans to address the need to make adjustments to its original strategic plan.

- D. Column's information technology (IT) strategy most likely will be a critical element in successfully implementing the health plan's strategic plan.

Answer: B

NEW QUESTION 14

The Danner Bank loaned money to the CareWell Health Plan to fund an expansion of a healthcare facility. With respect to the type of financial information user Danner represents to CareWell, it is correct to say that Danner is an:

- A. Internal user with a direct financial interest

- B. Internal user with an indirect financial interest

- C. External user with a direct financial interest

- D. Case-mix adjustment

Answer: C

NEW QUESTION 15

The Zane health plan uses a base of accounting known as accrual-basis accounting. With regard to this base of accounting, it can correctly be stated that accrual-basis accounting

- A. Enables an interested party to view the consequences of obligations incurred by Zane, but only if the health plan ultimately completes the business transaction

- B. Is not suitable for measuring Zane's profitability

- C. Requires Zane to record revenues when they are earned and expenses when they are incurred, even if cash has not actually changed hands

- D. Prohibits Zane from making adjusting entries to its accounting records at the end of each accounting year

Answer: C

NEW QUESTION 16

The following information was presented on one of the financial statements prepared by the Rouge Health Plan as of December 31, 1998:

Rouge’s current ratio at the end of 1998 was approximately equal to:

- A. 0.84

- B. 1.06

- C. 1.19

- D. 1.31

Answer: C

NEW QUESTION 17

The Coral Health Plan, a for-profit health plan, has two sources of capital:

Debt and equity. With regard to these sources of capital, it can correctly be stated that

- A. Coral's equity holders have an ownership interest in the health plan

- B. The interest that Coral pays on its debt most likely is not tax deductible to Coral

- C. Coral's debt holders have no legal claim to Coral's assets

- D. Equity is a more risky source of capital, from Coral's perspective, than is debt

Answer: A

NEW QUESTION 18

Analysts will use the capital asset pricing model (CAPM) to determine the cost of equity for the Maxim health plan, a for-profit plan. According to the CAPM, Maxim's cost of equity is equal to

- A. The average interest rate that Maxim is paying to debt holders, adjusted for a tax shield

- B. Maxim's risk-free rate minus its beta

- C. Maxim's risk-free rate plus an adjustment that considers the market rate, at a given level of systematic (non diversifiable) risk

- D. Maxim's risk-free rate plus an adjustment that considers the market rate, at a given level of nonsystematic (diversifiable) risk

Answer: C

NEW QUESTION 19

One true statement about cash-basis accounting is that

- A. Cash receipt, but not cash disbursement, is an important component of cash-basis accounting

- B. Most companies use a pure cash-basis accounting system

- C. Cash-basis accounting records revenue according to the realization principle and expenses according to the matching principle

- D. Health insurance companies and health plans that fall under the jurisdiction of state insurance commissioners must report some items on a cash basis for statutory reporting purposes

Answer: D

NEW QUESTION 20

The Longview Hospital contracted with the Carlyle Health Plan to provide inpatient services to Carlyle’s enrolled members. Carlyle provides Longview with a type of stop-loss coverage that protects, on a claims incurred and paid basis, against losses arising from significantly higher than anticipated utilization rates among Carlyle’s covered population. The stop-loss coverage specifies an attachment point of 130% of Longview’s projected $2,000,000 costs of treating Carlyle plan members and requires Longview to pay 15% of any costs above the attachment point. In a given plan year, Longview incurred covered costs totaling $3,000,000.

For the year in which Longview’s incurred covered costs were $3,000,000, the amount for which Longview will be responsible is:

- A. $2,000,000

- B. $2,600,000

- C. $2,660,000

- D. $3,900,000

Answer: C

NEW QUESTION 21

......

100% Valid and Newest Version AHM-520 Questions & Answers shared by Downloadfreepdf.net, Get Full Dumps HERE: https://www.downloadfreepdf.net/AHM-520-pdf-download.html (New 215 Q&As)